- BY Colin Yeo

What is the no recourse to public funds condition?

Page contents

- What is the legal basis for the “no recourse to public funds” condition?

- When do the immigration rules say the “no recourse to public funds” condition should be imposed?

- What is Home Office policy on when the “no recourse to public funds” condition will not be imposed or can be lifted from leave granted on the basis of their family or private life or in the Hong Kong BN(O) route?

- Can people who are not in the family, private life or Hong Kong BN(O) routes get the condition lifted from their leave?

- Who is affected?

- Have there been legal challenges to the “no recourse to public funds” condition?

- What public funds does the condition prevent access to?

- What services are still available?

The “no recourse to public funds” condition is imposed on grants of limited leave to enter or remain with the effect of prohibiting the person holding that leave from accessing certain defined public funds, set out at paragraph 6 of the immigration rules. A person who deliberately claims public funds despite such a condition is committing a criminal offence. There may well be future immigration consequences as well.

Section 115 of the Immigration and Asylum Act 1999 prevents people subject to immigration control from accessing a range of welfare benefits unless they fall into one of the exceptions.

It is possible to ask the Home Office to lift the condition from a person’s grant of leave, following which they can access benefits that they are eligible for. See our briefing on how to make those applications for full details.

What is the legal basis for the “no recourse to public funds” condition?

The current policy of imposing a “no recourse to public funds” requirement in human rights cases was introduced on 9 July 2012, initially via the immigration rules and later in primary legislation. Prior to that the policy had been to allow access to public funds in human rights cases.

When limited leave to enter or remain is granted to a person, the Immigration Act 1971 allows the Secretary of State to impose certain conditions on that leave. This power is conferred by section 3 of the Act. Among the possible conditions is one requiring the person “to maintain and accommodate himself, and any dependants of his, without recourse to public funds”.

This is a discretionary power. It does not have to be used. Decisions on when the various powers will and will not be used are guided by the immigration rules.

When do the immigration rules say the “no recourse to public funds” condition should be imposed?

In practice, the “no recourse to public funds” condition is imposed on almost everyone granted limited leave. For example, partners, spouses, children, parents of a child in the UK and adult dependent relatives all have the condition imposed on their leave in most cases.

There are some exceptions, these have been widened considerably over the past few years, predominantly as the result of strategic litigation. For example, if leave was granted on the basis of private life under Appendix Private Life then we look at paragraph PL 10.5 of the rules:

The grant of permission will be subject to the following conditions:

(c) if the decision maker is satisfied that:

(i) the applicant is destitute, as defined in section 95 of the Immigration and Asylum Act 1999, or is at risk of imminent destitution; or

(ii) there are reasons relating to the welfare of a relevant child which outweigh the considerations for imposing or maintaining the condition (treating the best interests of a relevant child as a primary consideration), or

(iii) the applicant is facing exceptional circumstances affecting their income or expenditure,

then the applicant will not be subject to a condition of no access to public funds. If the decision maker is not so satisfied, the applicant will be subject to a condition of no access to public funds.

For family cases made under Appendix FM and for BNO visa holders, identical wording is used at paragraph GEN.1.11A and HK 65.1 respectively. Note the use of ‘or’ which means that only one of these reasons needs to apply, although more than one may be applicable.

The general rule for these categories is therefore that the “no recourse to public funds” condition will normally be imposed but there is a discretion not to. As ever, it is important to then turn to Home Office guidance to see how the rules work in practice.

What is Home Office policy on when the “no recourse to public funds” condition will not be imposed or can be lifted from leave granted on the basis of their family or private life or in the Hong Kong BN(O) route?

Home Office policy on when a “no recourse to public funds” condition might not be imposed or can be lifted from these routes is set out in the Family life and exceptional circumstances guidance:

Access to public funds

In all cases where you are granting entry clearance or permission to stay as a parent on the 5-year route to settlement, you must grant with no access to public funds.

In all cases where you are granting entry clearance or permission to stay as a parent on the 10-year route to settlement, you must consider whether to grant access to public funds.

You must grant access to public funds where the applicant has provided satisfactory evidence that:

- they are destitute or at risk of imminent destitution

- there are reasons relating to the welfare of a relevant child which outweigh any reasons for not allowing access

- they are facing exceptional financial circumstances relating to their income or expenditure.

More detailed guidance on how these decisions are made is set out in ‘Access to public funds within family, private life and Hong Kong BN(O) routes’. This states that when granting leave under Appendix FM or Appendix Private Life, decision makers must consider whether there is evidence that the condition should not be applied.

If already granted leave, those within Appendix FM, Appendix Private Life and the Hong Kong BN(O) route can apply to have the condition lifted. This is called a change of conditions application.

Some common examples of where it may be necessary to have the condition lifted could include where there has been a relationship breakdown, or a new baby meaning the mother cannot work, or where someone has lost their job or is on a zero hours contract, or where ill health prevents the person from working.

The guidance is explicit that evidential flexibility applies with these applications. This means that a decision can be made without every piece of evidence or information required by the online application. This applies where the decision maker is satisfied that “clear and compelling” evidence of the applicant’s financial situation has been provided and demonstrates that they meet the criteria to have the condition lifted.

The guidance also provides for two requests for further evidence to be made before an application is rejected.

Where a local authority has assessed a person as destitute, the Home Office will nevertheless conduct its own assessment. However receipt of section 17 support is very strong evidence that the condition should be lifted.

The Home Office also expects that evidence is provided with every application for further leave to remain, regardless of whether an applicant has previously been granted leave without a condition of no recourse to public funds.

People who were granted leave to enter and remain in the UK on the basis of their family and private life without recourse to public funds and who now wish to request removal of that condition can apply to the Home Office separately. This is called a change of conditions application.

Can people who are not in the family, private life or Hong Kong BN(O) routes get the condition lifted from their leave?

The Home Office confirmed in a recent case that the no recourse to public funds restriction could also be lifted from a person’s leave in other immigration routes. However, the circumstances where this can be done are still expected to be quite limited. People who have had to meet a financial requirement (i.e. to have or earn a certain amount of money) should take legal advice before making a change of conditions application. There is a risk that making the application could affect their leave if they tell the Home Office that their financial circumstances have changed.

Applications made in these other routes will be dealt with under the ‘Public Funds: Migrant access to public funds, including social housing and homelessness assistance, and social care’ guidance.

The guidance states:

Whilst a person in most circumstances outside of a family life, private life or Hong Kong BN(O) route would not be granted a change of condition, section 3(1)(c)(ii) of the 1971 Immigration Act provides the Secretary of State power to exercise discretion in considering whether to vary the conditions of any leave granted, including the lifting of NRPF from permission granted in all immigration routes.

In considering whether to lift (or not impose) a NRPF condition on someone present in the UK there is a wide discretion which requires all relevant matters to be taken into account. In particular:

- in any application involving a child the best interests of that child must be considered as a primary, although not the only consideration – Section 55 guidance

- where an applicant, or their dependant children, cannot reasonably be expected to return to their home country NRPF must be lifted if it is established that they are destitute, or at imminent risk of destitution or there are other particularly compelling reasons relating to the welfare of the child or other matters

- where an applicant, or their dependant children, can reasonably be expected to return to their home country the expectation is that they should do so – particularly compelling circumstances will need to be established to require the NRPF condition to be lifted

If the reason the person states they cannot return to their country of nationality amounts to a protection or human rights claim, the claim itself should not be considered. Instead, the individual should be encouraged to make an appropriate application based on their primary reason for wanting to stay in the UK, such as a protection claim or family life application, so their circumstances can be properly considered.

It appears from the above that where a person outside the family, private life or Hong Kong BN(O) routes makes a change of conditions application, the Home Office will consider whether the person making the request should return to their country of origin rather than be given access to public funds. There may be a risk that leave could be cancelled, particularly in routes where there is a financial requirement.

The Home Office guidance ‘Cancellation and curtailment of permission’ indicates that where a person claims public funds this may be deemed “Failure to comply with conditions of permission to enter or stay (includes permission extended under section 3C of the Immigration Act 1971)”, as they have been unable to maintain or accommodate themselves and any dependants without recourse to public funds. The guidance states that leave could potentially be cancelled under the immigration rules:

9.8.8. Permission (including permission extended under section 3C of the Immigration Act 1971) may be cancelled where the person has failed to comply with the conditions of their permission.

Some people may have been granted leave where a sponsor has provided a “maintenance undertaking”. The public funds guidance also states: “It is an offence under the Social Security Administration Act 1992 for a sponsor not to maintain people who they are responsible for who then claim contributory based benefits because of this. These benefits may also be recovered from the sponsor.”

People in any of these situations should seek advice before they make a change of conditions application.

Who is affected?

The Unity Project charity and law firm Deighton Pierce Glynn have published a report examining the disproportionate effect of the no recourse to public fund condition on women, low-income families, disabled people, pregnant women and black and ethnic minority British children.

One story which particularly stood out was that of a single mother called Sarah. Sarah had two children, one of which was British. Despite working full-time, Sarah’s rent was so high that she was forced to move into a single room where the three of them had to share a bed. Often, the family had to relieve themselves in the garden because of the lack of access to the shared toilets.

In October 2023, Joseph Rowntree Foundation published a report ‘Destitution in the UK 2023‘ which found that migrants are disproportionately affected by destitution and that “most migrant destitute households (no complex needs) were from minority ethnic groups, with the larger share from Asian followed by Black groups.”

Migration Observatory published a report in November 2023 ‘Deprivation and the no recourse to public funds restriction‘ which found that just under 100,000 people with less than five years’ residence in the UK live in economically vulnerable households with dependent children.

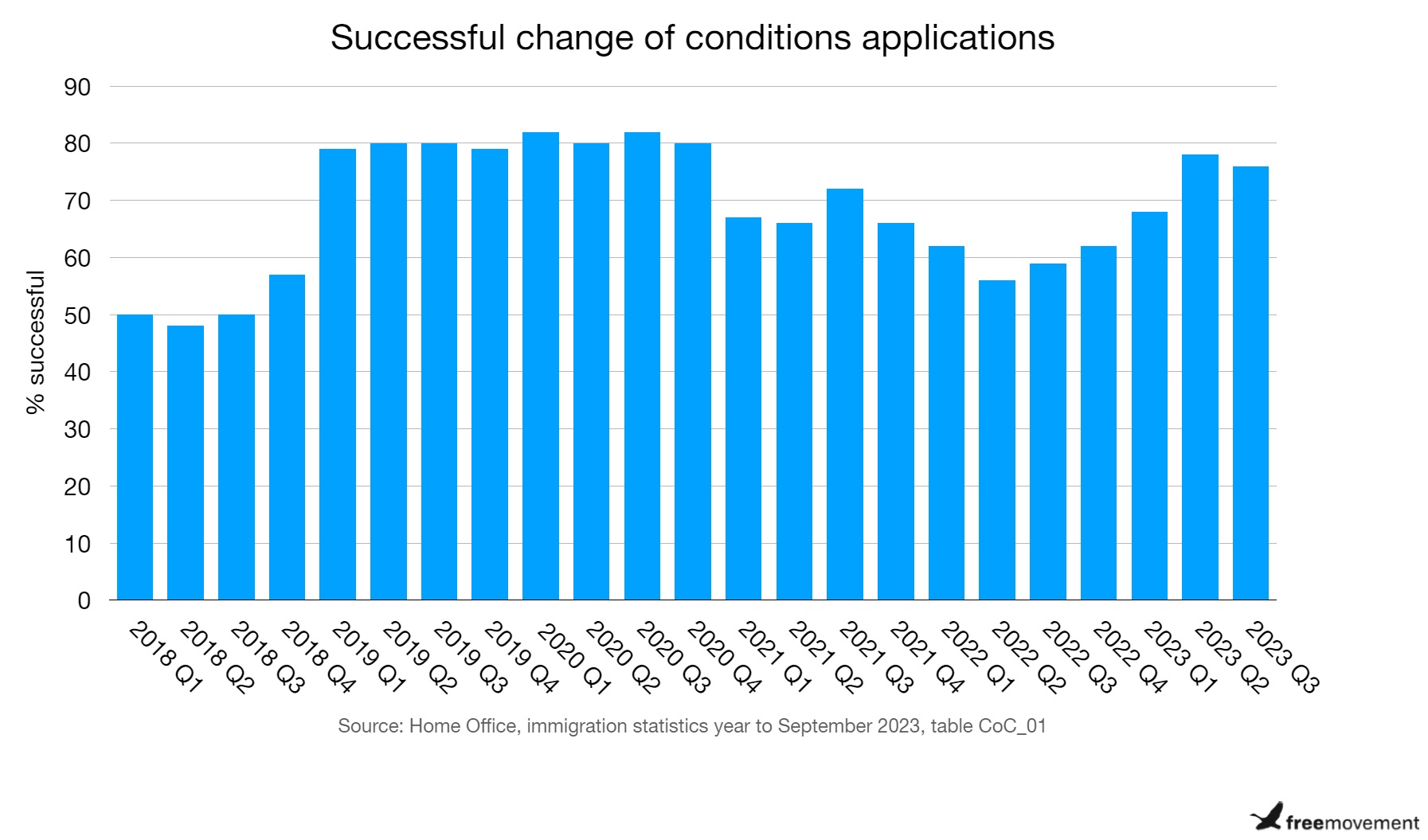

The statistics for the year ending June 2023 show that for the period April to June 2023, 868 change of conditions applications were made and 506 decisions made. Two thirds of the applications during this period were made by women. The overall success rate was 78% which demonstrates that these applications are worth doing. Despite this, many people still seem unaware that this is an option.

Have there been legal challenges to the “no recourse to public funds” condition?

Yes. The policy was initially challenged in R (Khadija BA Fakih) v Secretary of State for the Home Department IJR [2014] UKUT 513 (IAC). In this case it was argued that the change of policy was not brought about in the right legal way. The case succeeded but the Home Office responded by reintroducing the change by the correct legal means.

A challenge to the legality of the no recourse to public funds policy was then due to be heard by the High Court in March 2019. Before the case went to trial the Home Office conceded that the policy should be reviewed and that the claimants should receive compensation.

Since then, strategic litigation in this area has continued at pace:

- May 2020: High Court rules against government on no recourse to public funds

- May 2020: Part of no recourse to public funds policy declared unlawful: full judgment out

- May 2020: Home Office softens no recourse to public funds policy following High Court defeat

- May 2021: Fresh blow to “no recourse to public funds” scheme

- February 2022: Home Office suspends ten-year route punishment for migrants granted public funds

- June 2022: Home Office policy on no recourse to public funds found unlawful, again

- February 2023: No damages for unlawful no recourse to public funds policy

- March 2023: No recourse to public funds policy found unlawful (again)

- October 2023: Home Office concedes latest challenge to no recourse to public funds policy

All of this litigation has been brought by Deighton Pierce Glynn on behalf of their clients, with the support of The Unity Project.

What public funds does the condition prevent access to?

There is a definitive list of what counts as “public funds” for the purposes of the Immigration Rules at paragraph 6:

- adult disability payment (Scotland)

- attendance allowance

- carer’s allowance

- carer’s allowance supplement (Scotland)

- child benefit

- child disability payment (Scotland)

- child tax credit

- council tax benefit

- council tax reduction

- disability living allowance

- discretionary support payments by local authorities or devolved administrations in Scotland and Northern Ireland which replace the discretionary social fund

- funeral support

- housing and homelessness assistance

- housing benefit

- income-based jobseeker’s allowance

- income related employment & support allowance

- income support

- personal independence payment

- Scottish child payment

- severe disablement allowance

- social fund payment, such as winter fuel or cold weather payments

- state pension credit

- universal credit

- welfare fund payment (Scotland)

- winter heating payment and child winter heating assistance (Scotland)

- working tax credit

There are some exceptions for nationals of certain countries, including Croatia, Morocco, San Marino, Tunisia and Turkey, for example relating to tax credits. For more details of the exceptions refer to the ‘Public Funds’ guidance.

In respect of child and working tax credits, it is important to highlight that if only one member of a couple is subject to immigration control, then for most tax credits purposes neither are treated as being subject to immigration control.

The rules on child benefit are more complex, as this is on the list of public funds that cannot be claimed but certain countries have an agreement with the UK for their nationals to claim child benefit. Certain other countries’ nationals can claim if they are working. The details and applicable countries are here.

There are also exceptions for people who have had someone give a maintenance undertaking on their behalf.

What services are still available?

Free school meals are available to those with no recourse to public funds, the full guidance is here.

Benefits and services not listed in paragraph 6 of the rules are still available. This includes contributory benefits, council tax discounts such as the sole occupancy discount and other services such as health and state funded schooling. There may be other obstacles to accessing those services, such as passport checks for NHS access and only certain people qualifying for home tuition fees or maintenance grants but these are not directly linked to the “no recourse to public funds” condition.

Benefits not within the definition of public funds include:

- Contribution based Jobseeker’s Allowance

- Guardian’s allowance

- Incapacity Benefit

- Contribution-based Employment and Support Allowance (ESA)

- Maternity allowance

- Retirement pension

- Statutory maternity pay

- Statutory sickness pay

- Widow’s benefit and bereavement benefit

Housing provided by a housing association does not count as access to public funds and there are other exceptions as well.

The Unity Project provides pro bono legal support to migrants facing homelessness or extreme poverty because of the no recourse to public funds condition: www.unity-project.org.uk.

The NRPF Network has more detailed information about the benefits and services that those with the no recourse to public funds restriction can and cannot access.

This article was originally published in February 2017 written by Colin Yeo and has been updated so that it is correct as of the new date of publication. Thanks to Bilaal Shabbir for his assistance with a previous update.

SHARE

3 Responses